Partnership Deed Its Importance And Rights Of Partners Accounting Finance

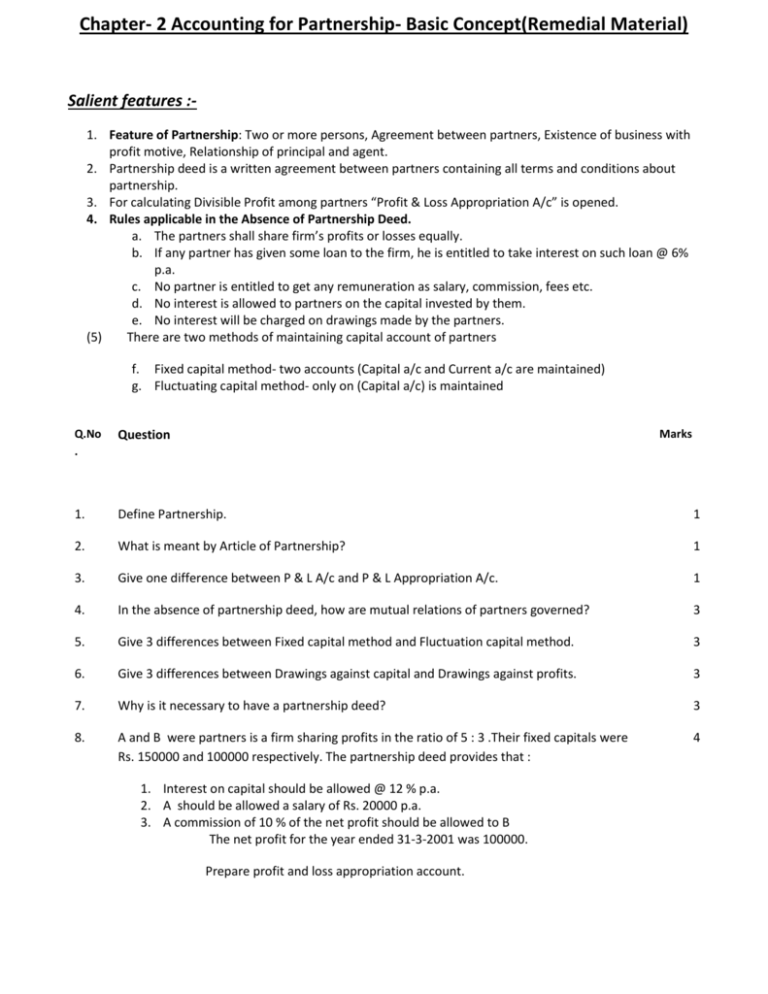

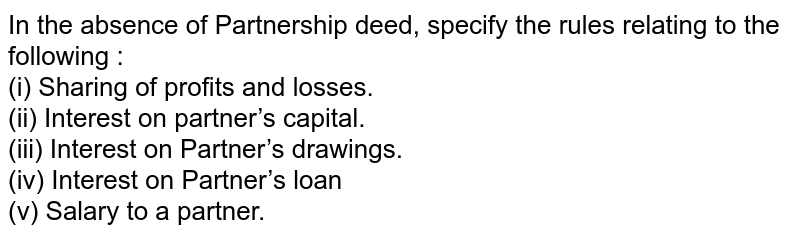

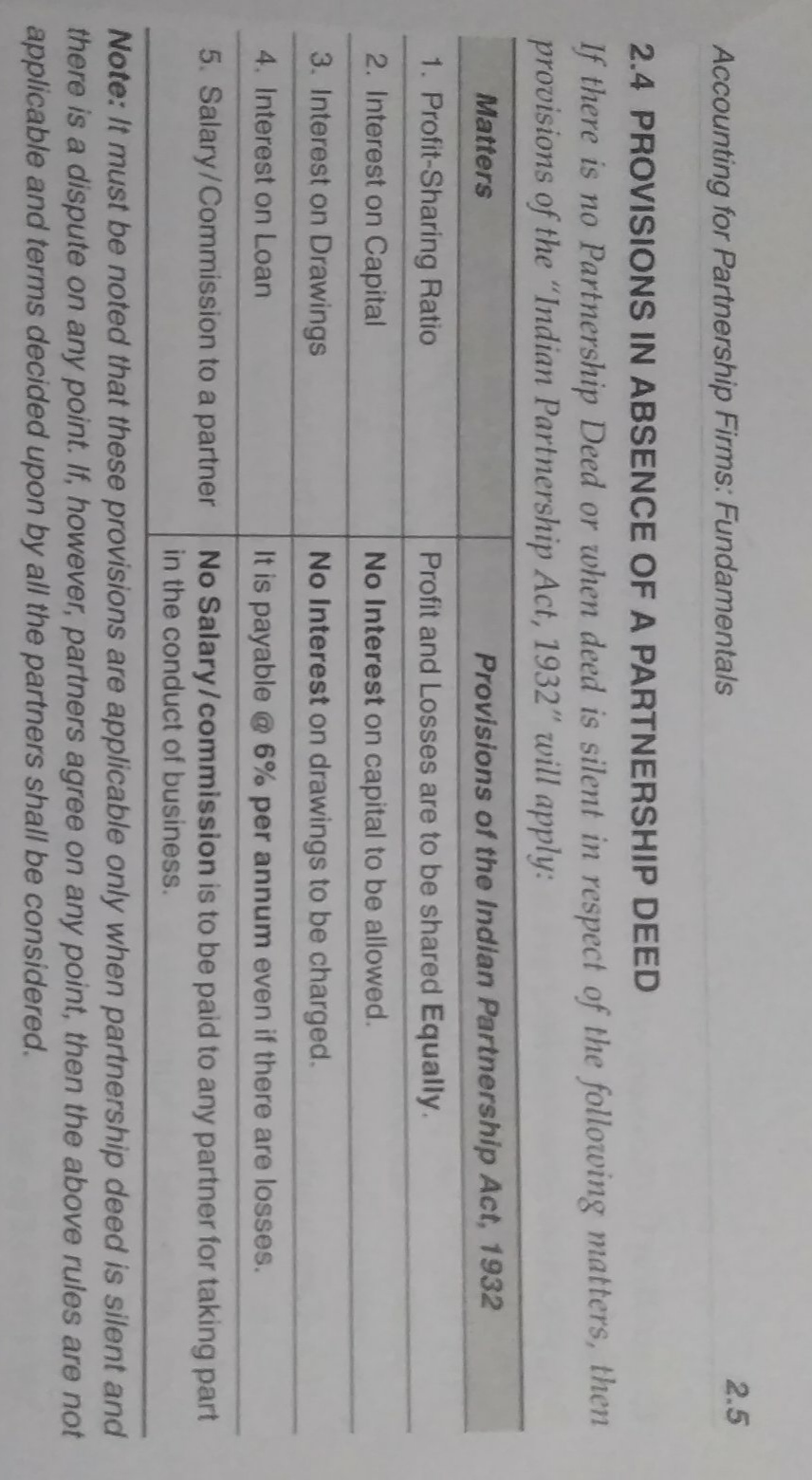

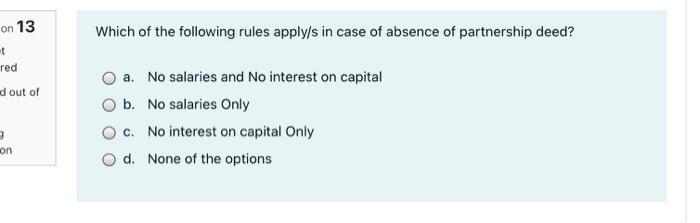

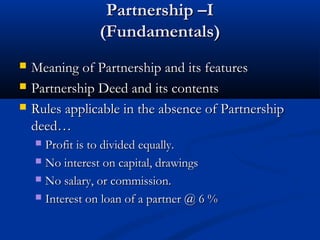

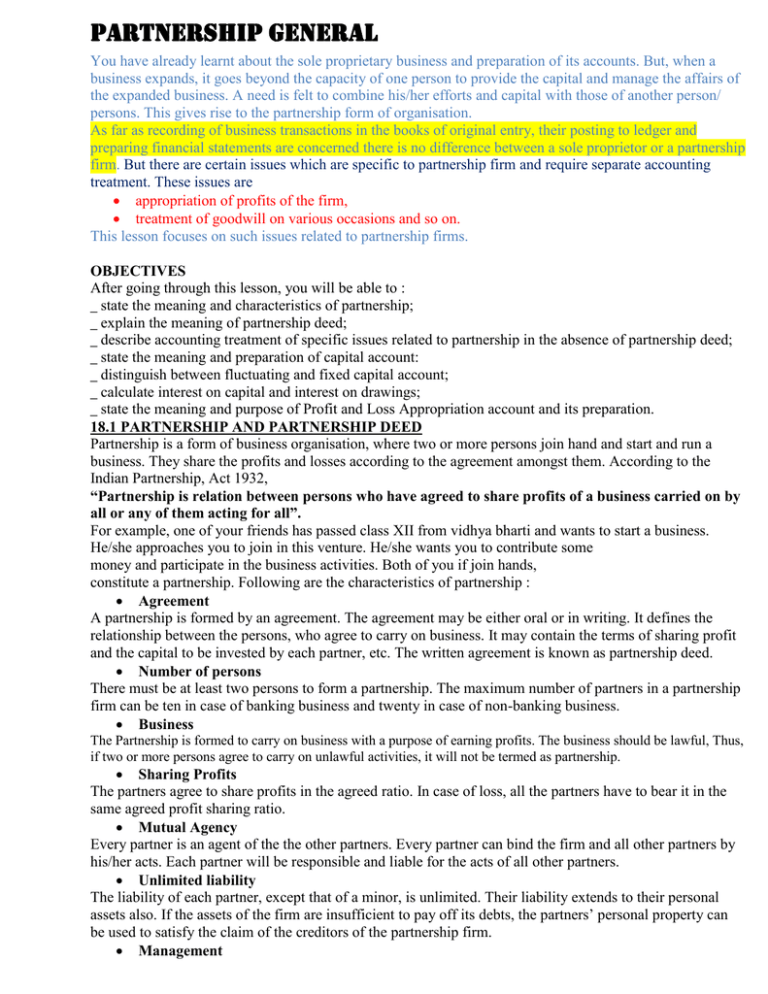

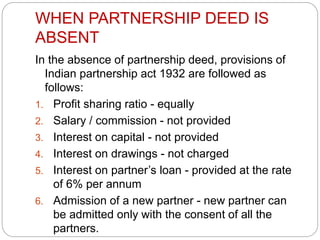

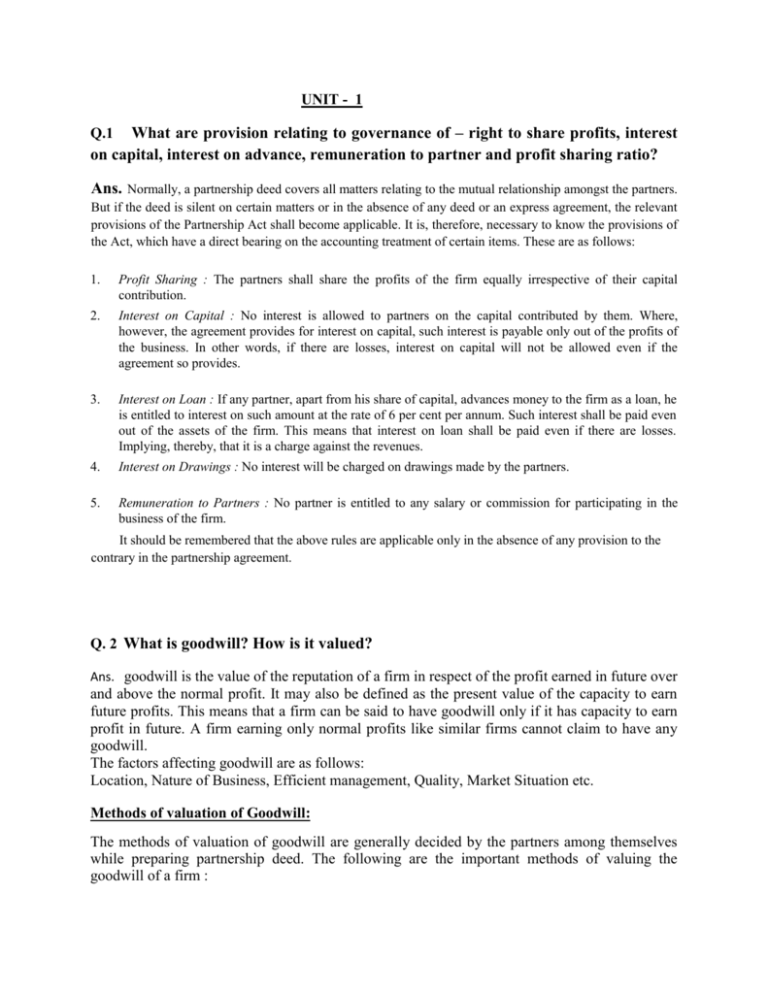

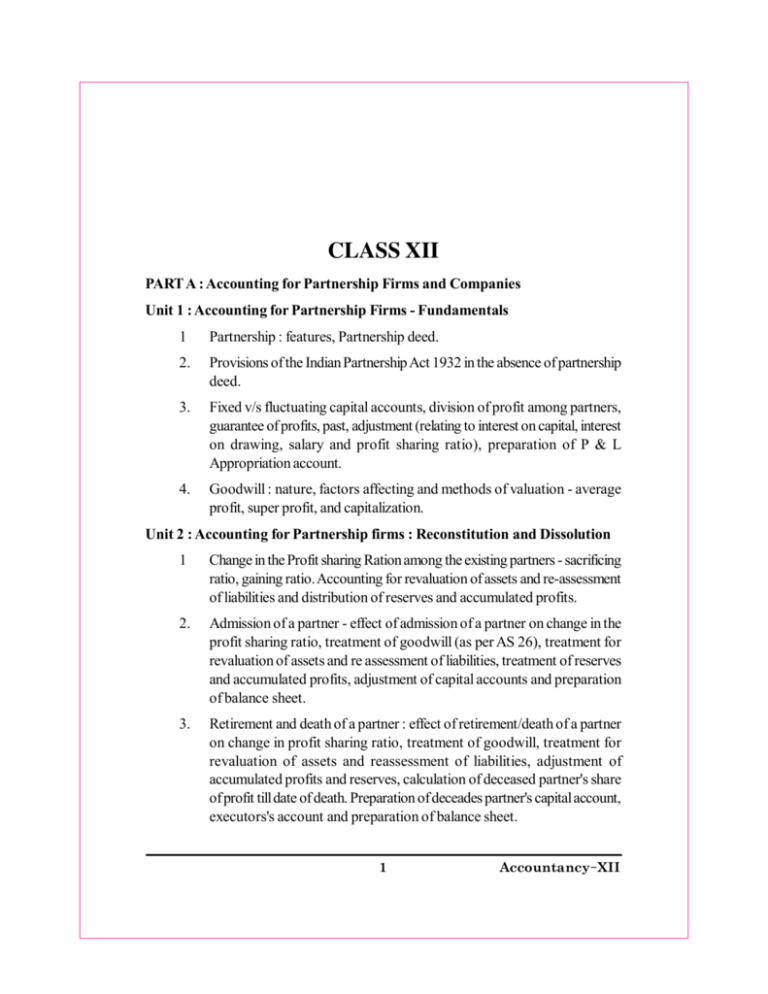

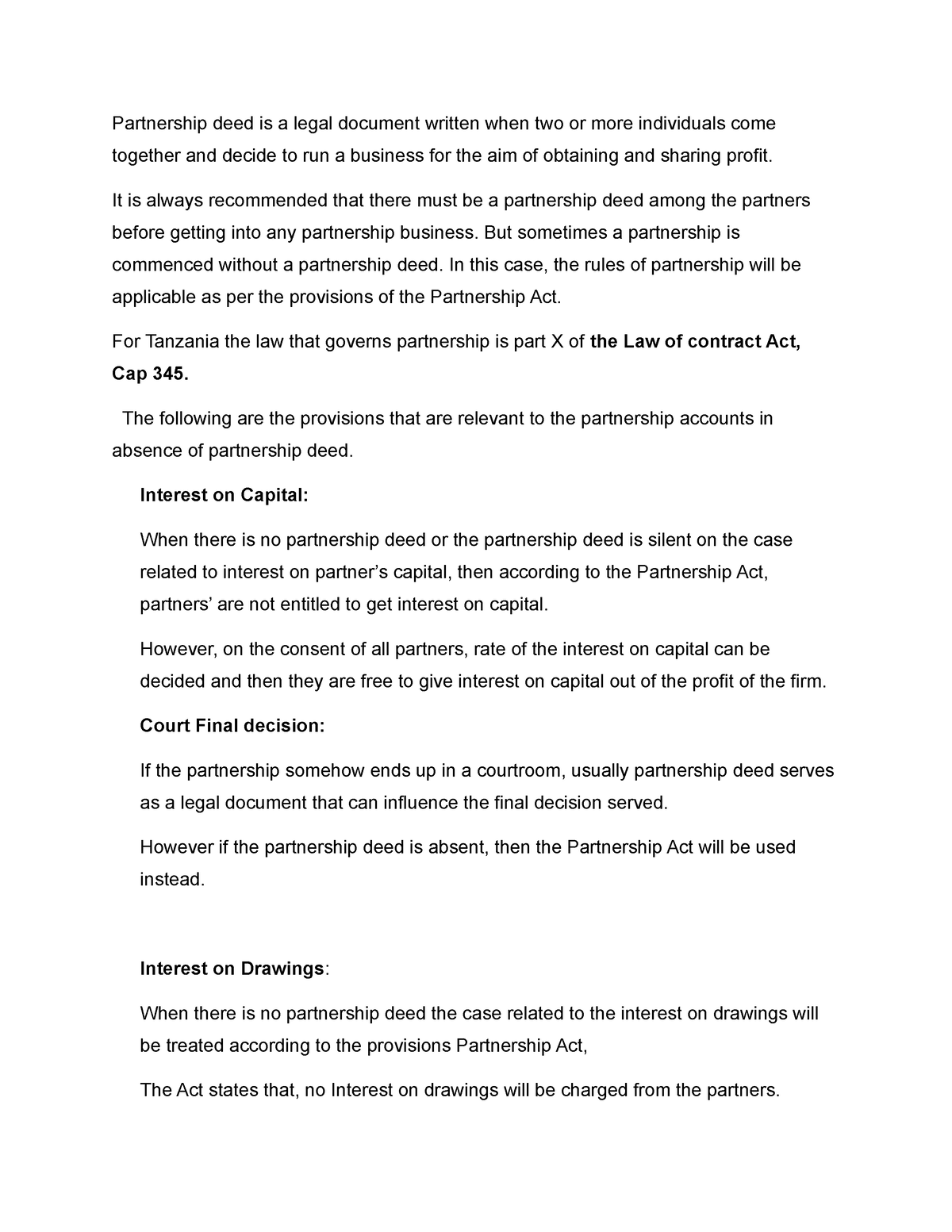

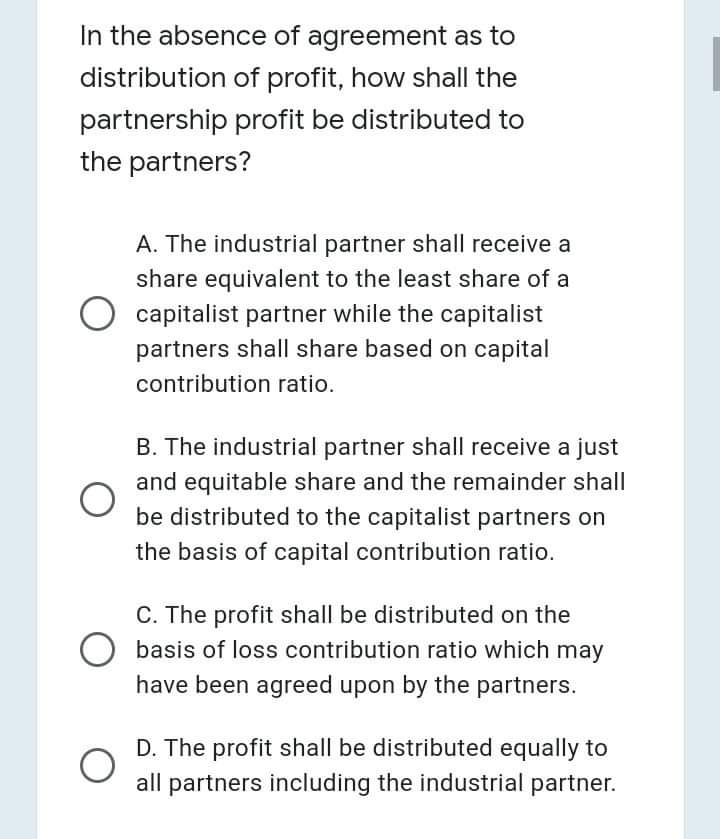

In the absence of the Partnership Deed, Interest on Capital A is allowed @ 6% per annum B is allowed @ 10% per annum C is allowed at the borrowing rate D is notIn the absence of a partnership deed, the following rules have to be followed 1 The partners are entitled to share the profits or losses equally 2 Partners are not entitled to interest on their

In the absence of partnership deed the interest is allowed on partners capital mcq

In the absence of partnership deed the interest is allowed on partners capital mcq-In the absence of a partnership deed, the allowable rate of interest on a partners loan account will be A 4 % pa B 5 % pa C 6 % pa D 75 % pa Medium Solution Verified by Toppr CorrectL, M and N are partners in a firm sharing profits & losses in the ratio of 2 3 5 On their fixed capitals were Rs 2,00,000, Rs 3,00,000 and Rs 4,00,000 respectively Their

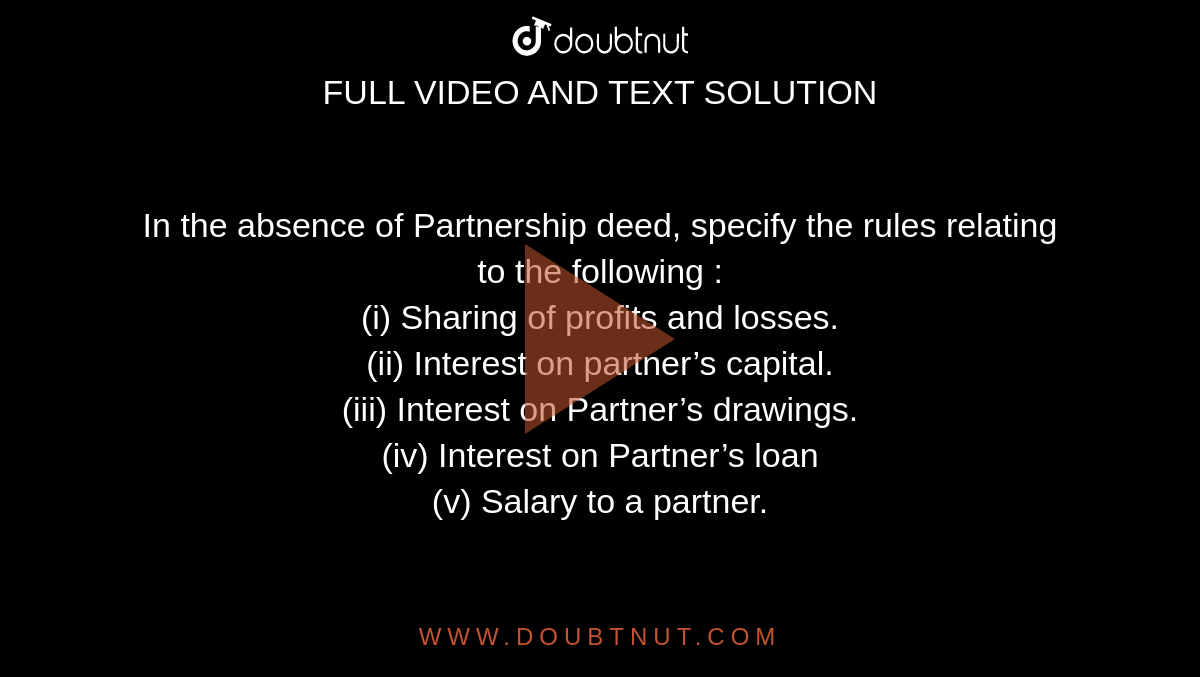

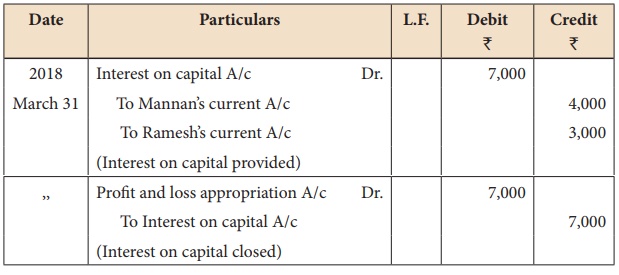

Accounting Treatment For Interest On Partner S Capital Geeksforgeeks

(i) Profit Sharing Ratio When a partnership deed is not made or even if it is made and silent on sharing of profit or losses among the partners of a firm, then according to theAnswer C) No interestIf there is absence of partnership deed or partnership deed remains silent regarding profit/losses of partners then profit sharing ratio among partners will be a) Equal b) In the ratio of capital c)

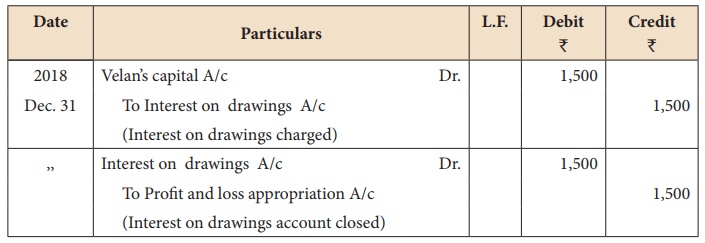

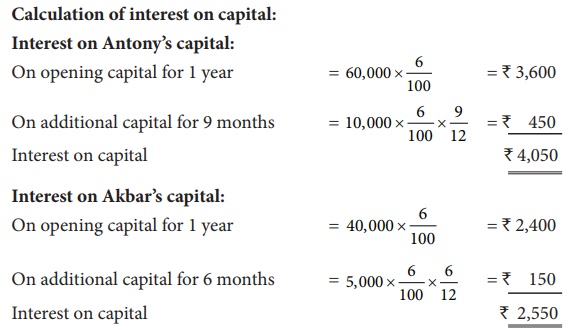

Where the partnership deed provides for payment of interest on capital and it does not mention the rate of interest to be paid, it is a convention to pay interest @ 6% pa On What Balance is It is not the claim of the Department that the assessee was not eligible to be assessed to tax under section 44AD of the Act or that the interest and remuneration paid to(iii) Interest on partner's drawings If the partnership deed is silent on interest on partner's drawings, then according to the Partnership Act of 1932, no interest on drawing should be

In the absence of partnership deed the interest is allowed on partners capital mcqのギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

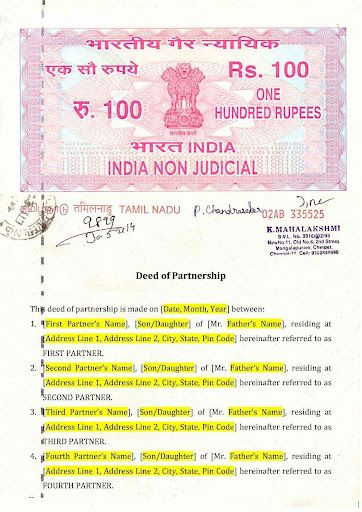

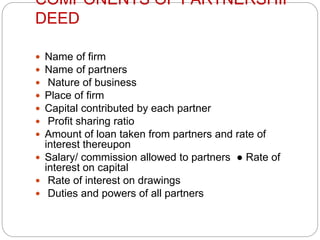

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty | Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty | Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty | Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty | Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty | Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty | Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

「In the absence of partnership deed the interest is allowed on partners capital mcq」の画像ギャラリー、詳細は各画像をクリックしてください。

Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |  Partnership Deed Meaning Format Registration Stamp Duty |

Partnership Deed Meaning Format Registration Stamp Duty | Partnership Deed Meaning Format Registration Stamp Duty |

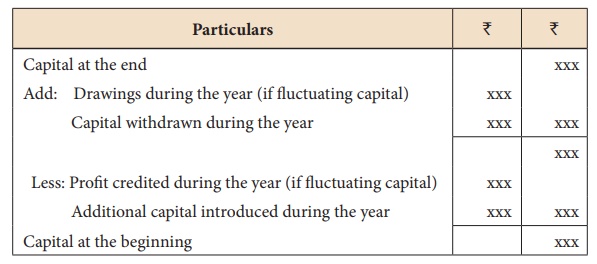

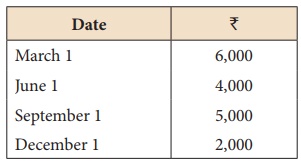

(ii) Interest on Capital When there is absence of partnership deed or the partnership deed is silent on the issue related to interest on partner's capital, then according 4 Interest on loan If any partner, apart from his share capital, advances money to the firm as loan, he is entitled to interest on such amount at the rate of six percent per annum 5

Incoming Term: in absence of partnership deed interest on capital is, in the absence of partnership deed allowable interest on partners capital is, in the absence of partnership agreement interest on capital is paid only out of, in the absence of partnership deed the interest is allowed on partners capital mcq,

0 件のコメント:

コメントを投稿